How to figure out your subsidy for Health Insurance

We go over this with clients individually and also have a pretty great website with tools to allow consumers to figure it out. However, we still get questions about fines, coverages and what if’s. That is why we are here and took the time to become certified brokers for all 3 health insurance exchanges in the area.

First of all Maryland Health Connection is for Maryland residents only. Also only if you are eligible for subsidies as you are still allowed to shop off exchange for the same plans. DC Health Link is for all D.C. residents to use for obtaining health coverage if not covered under an employer sponsored plan. The Marketplace for Health Insurance which is the Federal exchange is for Virginia residents also eligible for subsidies as well as the other 35 states that have elected to be a part of the Federal exchange. Virginia residents also can shop off exchange for plans as well.

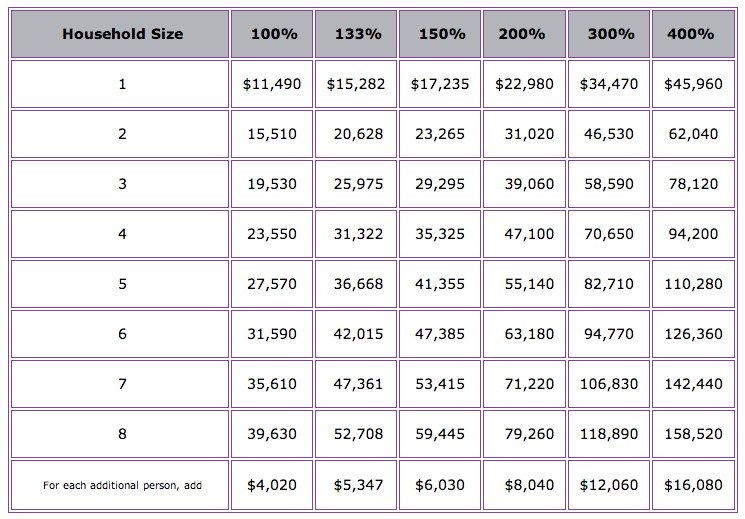

So where does that leave us. Oh, yes getting back to the subsidies. Officially they are called advanced premium tax credits. When you estimate your income for the coming year, they are basing your subsidy on that estimate as well as your previous years taxable income. That is not what you earn, but the number that you actually pay taxes on. Use the FPL income guidelines chart to see where your level is. It is based on who is actually on the tax return which translates into household members. Now use the subsidy calculator and input your income and family members. The calculator will give you several numbers as FPL level but you need to use the monthly premium cap number in your calculations. Write it down.

Now choose your carrier and choose carefully. You are purchasing a plan that not only offers benefits but liability levels as well. Be sure to read the plan details and contact a broker if you have questions. When you enter in your home zip code and date of birth into a quote engine, it will generate all the plans that are available to you in your region. Pay special attention to the second best silver plan, which is the ACA benchmark that all subsidies are based on. Once you have the monthly premium amount for the second best silver plan, subtract the monthly premium cap amount from the calculator and that is your subsidy.

The most common misconception about subsidies is that it has to be used for a silver plan. That is not true. Take your subsidy amount and subtract that from any level plan and that would be your monthly cost. Remember that consumers can report income changes during the year to the exchanges that can increase or decrease your subsidy amount which then reflects your out of pocket monthly premium. If your income goes up you could have a reduction in subsidy or have it totally removed. If your income goes down, report the shortage of income and your subsidy will be increased. If you were overcompensated or under compensated during the year, it will reconcile at tax time with either a credit or a charge.

We hope this post is helpful in your quest to determine your subsidies and as always, we are here to help and be truthful.

Jack Fleming – Insurance Broker