2016 Federal Poverty Income Guidelines for Subsidies

/in Affordable Care Act, Affordable Health Care, Affordable Health Insurance, Blog, blog, Comrade Financial Group, DC Health Insurance, DC Insurance Broker, Instant Quote, Insurance Agent, Maryland Health Insurance, Maryland Insurance Broker, Virginia Health Insurance, Virginia Insurance Broker /by Jack FlemingHow to figure out your subsidy for Health Insurance

/in Affordable Care Act, Affordable Health Insurance, blog, Blog, Comrade Financial Group, Customer Service, DC Health Insurance, Insurance Renewals, Maryland Health Insurance, Self Employed Insurance, Virginia Health Insurance /by Jack FlemingWe go over this with clients individually and also have a pretty great website with tools to allow consumers to figure it out. However, we still get questions about fines, coverages and what if’s. That is why we are here and took the time to become certified brokers for all 3 health insurance exchanges in the area.

First of all Maryland Health Connection is for Maryland residents only. Also only if you are eligible for subsidies as you are still allowed to shop off exchange for the same plans. DC Health Link is for all D.C. residents to use for obtaining health coverage if not covered under an employer sponsored plan. The Marketplace for Health Insurance which is the Federal exchange is for Virginia residents also eligible for subsidies as well as the other 35 states that have elected to be a part of the Federal exchange. Virginia residents also can shop off exchange for plans as well.

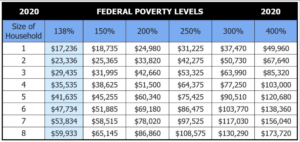

So where does that leave us. Oh, yes getting back to the subsidies. Officially they are called advanced premium tax credits. When you estimate your income for the coming year, they are basing your subsidy on that estimate as well as your previous years taxable income. That is not what you earn, but the number that you actually pay taxes on. Use the FPL income guidelines chart to see where your level is. It is based on who is actually on the tax return which translates into household members. Now use the subsidy calculator and input your income and family members. The calculator will give you several numbers as FPL level but you need to use the monthly premium cap number in your calculations. Write it down.

Now choose your carrier and choose carefully. You are purchasing a plan that not only offers benefits but liability levels as well. Be sure to read the plan details and contact a broker if you have questions. When you enter in your home zip code and date of birth into a quote engine, it will generate all the plans that are available to you in your region. Pay special attention to the second best silver plan, which is the ACA benchmark that all subsidies are based on. Once you have the monthly premium amount for the second best silver plan, subtract the monthly premium cap amount from the calculator and that is your subsidy.

The most common misconception about subsidies is that it has to be used for a silver plan. That is not true. Take your subsidy amount and subtract that from any level plan and that would be your monthly cost. Remember that consumers can report income changes during the year to the exchanges that can increase or decrease your subsidy amount which then reflects your out of pocket monthly premium. If your income goes up you could have a reduction in subsidy or have it totally removed. If your income goes down, report the shortage of income and your subsidy will be increased. If you were overcompensated or under compensated during the year, it will reconcile at tax time with either a credit or a charge.

We hope this post is helpful in your quest to determine your subsidies and as always, we are here to help and be truthful.

Jack Fleming – Insurance Broker

2013 Health Insurance Subsidy Income Guidelines

/in Affordable Care Act, Affordable Health Care, Affordable Health Insurance, Blog, Comrade Financial Group, DC Group Health, DC Health Insurance, Essential Health Benefits, Family Insurance, Free Quote, Individual Heath Insurance MD DC VA, Instant Quote, Insurance Agent /by Jack FlemingHealth Insurance Subsidy Income Guidelines

Comrade Financial Group has helped many individuals and families in the Maryland, Washington D.C. and Virginia are obtain Health Insurance with and without subsidies. It is important to remember that this subsidy is an advanced tax credit to help with the monthly premium and not a gift. The amount of help depends on your tax filing status and MAGI which is Modified Gross Adjusted Income. See the chart below for income guidelines to see if you fall into the Federal FPL guidelines.

Each year when you complete your tax return, your income is calculated and if you have had insurance for more than 9 months you will not have to pay the ACA penalty. If you have not, there are penalties that increase for the next 3 years, unless the ACA gets repealed. Based on that income your subsidy could increase or decrease. For more information please call us.

Thank you

Jack Fleming – Insurance Broker

About our Insurance Agency

/in 401K Rollover, Affordable Health Care, Affordable Health Insurance, Annuity Income Rider, Blog, Comrade Financial Group, Customer Service, DC Annuity, DC Group Health, DC Health Insurance, DC Income Annuity, DC Life Insurance, Dental Insurance, Disability Insurance, Family Insurance, Final Expense Insurance, Fixed Annuity, Free Quote, Home Owners Insurance, Indexed Universal Life Insurance, Individual Heath Insurance MD DC VA, Instant Quote, Insurance Agent, Maryland Annuity, Maryland Group Health, Maryland Health Insurance, Maryland Income Annuity, Maryland Life Insurance, Safe Money, Saving Money, Self Employed Insurance, Virginia Annuity, Virginia Group Health, Virginia Health Insurance, Virginia Income Annuity, Virginia Life Insurance, Whole Life Insurance /by Jack FlemingWe put together a quick video telling the world a little bit about why we started, what we do and why we do it. Enjoy and share with your friends. Thanks

Health Insurance Options

/in Affordable Health Care, Affordable Health Insurance, Blog, Comrade Financial Group, DC Group Health, DC Health Insurance, Family Insurance, Insurance Renewals, Maryland Group Health, Maryland Health Insurance, Self Employed Insurance, Virginia Group Health, Virginia Health Insurance /by Jack FlemingComrade Financial Group put together this brief video going over changes for Health Insurance under the Affordable Care Act for residents in Maryland, DC and Virginia.

Open Enrollment Confusion

/in Affordable Health Care, Affordable Health Insurance, Blog, Comrade Financial Group, DC Group Health, DC Health Insurance, Family Insurance, Individual Heath Insurance MD DC VA, Maryland Group Health, Maryland Health Insurance, Saving Money, Self Employed Insurance, Virginia Group Health, Virginia Health Insurance /by Jack FlemingMost people are unaware that yes Obamacare or Affordable Care Act open enrollment starts on October 1st with effective dates of Jan 1, 2012. That is for individuals and family plans. The Small Business open enrollment will start Jan 1,2014 with effective date of Mar 31, 2012. The majority of the people still don’t have a clue about their current plans and if they will continue through that start of ACA implementation. If your current plan was in place prior to Mar 1, 2010 your plan could be grandfathered but please check to see if the benefit level is increasing to match the new required Essential Health Benefits. If not, then your plan is on the old system of doing things. Please check with a knowledgable broker on the subject if you are unclear.