How to figure out your subsidy for Health Insurance

/in Affordable Care Act, Affordable Health Insurance, blog, Blog, Comrade Financial Group, Customer Service, DC Health Insurance, Insurance Renewals, Maryland Health Insurance, Self Employed Insurance, Virginia Health Insurance /by Jack FlemingWe go over this with clients individually and also have a pretty great website with tools to allow consumers to figure it out. However, we still get questions about fines, coverages and what if’s. That is why we are here and took the time to become certified brokers for all 3 health insurance exchanges in the area.

First of all Maryland Health Connection is for Maryland residents only. Also only if you are eligible for subsidies as you are still allowed to shop off exchange for the same plans. DC Health Link is for all D.C. residents to use for obtaining health coverage if not covered under an employer sponsored plan. The Marketplace for Health Insurance which is the Federal exchange is for Virginia residents also eligible for subsidies as well as the other 35 states that have elected to be a part of the Federal exchange. Virginia residents also can shop off exchange for plans as well.

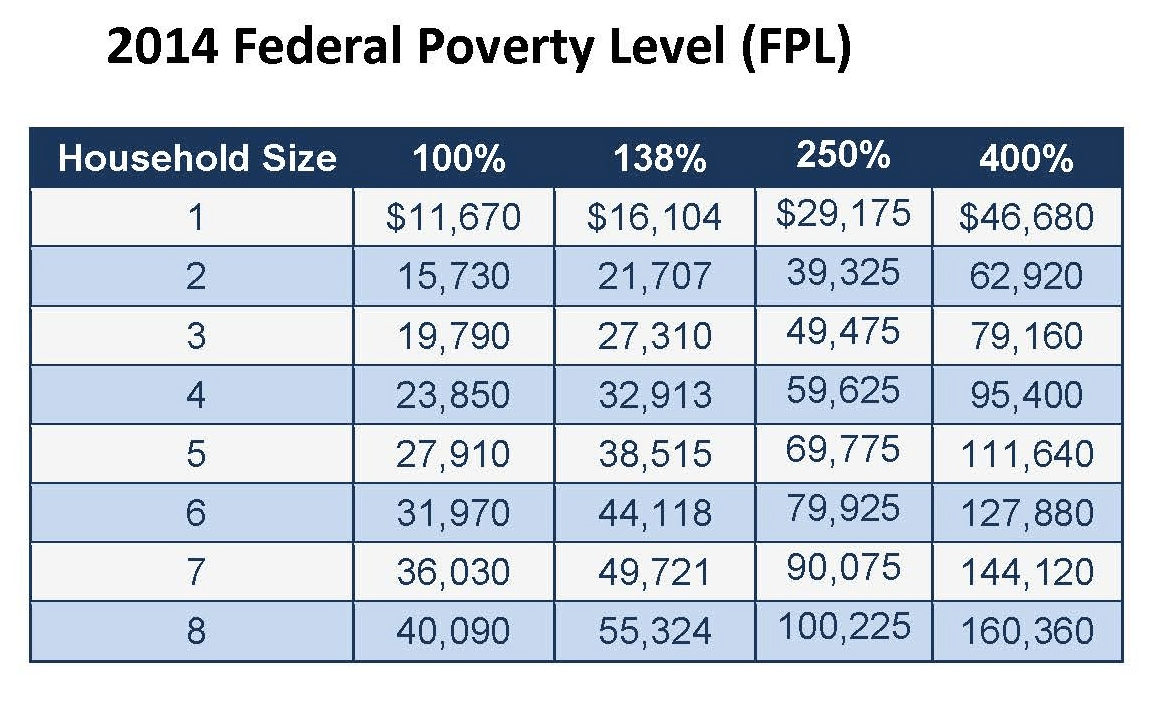

So where does that leave us. Oh, yes getting back to the subsidies. Officially they are called advanced premium tax credits. When you estimate your income for the coming year, they are basing your subsidy on that estimate as well as your previous years taxable income. That is not what you earn, but the number that you actually pay taxes on. Use the FPL income guidelines chart to see where your level is. It is based on who is actually on the tax return which translates into household members. Now use the subsidy calculator and input your income and family members. The calculator will give you several numbers as FPL level but you need to use the monthly premium cap number in your calculations. Write it down.

Now choose your carrier and choose carefully. You are purchasing a plan that not only offers benefits but liability levels as well. Be sure to read the plan details and contact a broker if you have questions. When you enter in your home zip code and date of birth into a quote engine, it will generate all the plans that are available to you in your region. Pay special attention to the second best silver plan, which is the ACA benchmark that all subsidies are based on. Once you have the monthly premium amount for the second best silver plan, subtract the monthly premium cap amount from the calculator and that is your subsidy.

The most common misconception about subsidies is that it has to be used for a silver plan. That is not true. Take your subsidy amount and subtract that from any level plan and that would be your monthly cost. Remember that consumers can report income changes during the year to the exchanges that can increase or decrease your subsidy amount which then reflects your out of pocket monthly premium. If your income goes up you could have a reduction in subsidy or have it totally removed. If your income goes down, report the shortage of income and your subsidy will be increased. If you were overcompensated or under compensated during the year, it will reconcile at tax time with either a credit or a charge.

We hope this post is helpful in your quest to determine your subsidies and as always, we are here to help and be truthful.

Jack Fleming – Insurance Broker

2014 Federal Poverty Level Chart

/in Affordable Care Act, Affordable Health Care, Affordable Health Insurance, Blog, blog, Comrade Financial Group, Customer Service, Instant Quote, Insurance Agent, Maryland Health Insurance /by Jack FlemingAbout our Insurance Agency

/in 401K Rollover, Affordable Health Care, Affordable Health Insurance, Annuity Income Rider, Blog, Comrade Financial Group, Customer Service, DC Annuity, DC Group Health, DC Health Insurance, DC Income Annuity, DC Life Insurance, Dental Insurance, Disability Insurance, Family Insurance, Final Expense Insurance, Fixed Annuity, Free Quote, Home Owners Insurance, Indexed Universal Life Insurance, Individual Heath Insurance MD DC VA, Instant Quote, Insurance Agent, Maryland Annuity, Maryland Group Health, Maryland Health Insurance, Maryland Income Annuity, Maryland Life Insurance, Safe Money, Saving Money, Self Employed Insurance, Virginia Annuity, Virginia Group Health, Virginia Health Insurance, Virginia Income Annuity, Virginia Life Insurance, Whole Life Insurance /by Jack FlemingWe put together a quick video telling the world a little bit about why we started, what we do and why we do it. Enjoy and share with your friends. Thanks

All about Life Insurance

/in Affordable Health Insurance, Blog, Customer Service, DC Health Insurance, DC Life Insurance, Family Insurance, Final Expense Insurance, Free Quote, Individual Heath Insurance MD DC VA, Maryland Life Insurance, Term Life Insurance, Virginia Life Insurance /by Jack Fleming All about Life Insurance

All about Life Insurance

Comrade Financial Group can offer you quotes in all 50 States for Term Life Insurance. All you have to do is go to the Term Life Quote section and fill in your information and it is that simple. You can obtain the quote for 10,15,20,30 or even longer. Term Insurance is the purest form of Insurance. You, the insured will pay a premium and the Insurance company will provide a death benefit. The older you get, the more expensive it is. So if you are in your 20’s or 30’s, that is the best time to get a 20 or 30 yr term policy. If you are single, then list your parents as beneficiaries. When you get married and have children, then you can change it with a simple form. There are many types of Life Insurance but Term is the cheapest and purest form of Insurance. Many will tell you that it meant a world of difference because a deceased person took the time and effort to get adequate Term coverage. Think about the people that will miss you when you are gone and those are the ones that will share the burden and cost that Life Insurance is there to absorb. Take the time and get a free quote. Thank You

Jack Fleming Insurance Broker

All About Annuities

/in 401K Rollover, Annuity Income Rider, Blog, Comrade Financial Group, Customer Service, DC Annuity, DC Income Annuity, Fixed Annuity, Free Quote, Maryland Annuity, Maryland Health Insurance, Maryland Income Annuity, Saving Money, Virginia Annuity, Virginia Income Annuity /by Jack FlemingAll About Annuities!

I really wanted to do a blog post about Annuities! In this Economic environment, you really can’t earn a decent return using CD’s. Okay, if you want 1%, that is fine, but with the inflation rate around 3%, you are going backwards. Annuities right now are giving 2 to 3 times that with simple Fixed Annuities. There are many carriers out there offering a variety of products like Fixed Annuities, but their rates are not that much above what you can get for a long term CD. The key is looking for the right Carrier. The best thing or concept I love about Annuities is that you will and can earn Interest on the Interest you already earned. So that is compounding in its most simple form. If you have some savings, a underperforming 401K, or you are just looking to start a rock solid Retirement Plan. I strongly suggest looking into Fixed Annuities as part of your Retirement portfolio. Remember that some Annuities will offer Withdrawal options, some at 5% and some at 10%, these are penalty free. Heck some carriers are offering Premium bonuses just to get one started. Also another important thing to remember that just like any other Insurance product, read everything and make sure you understand it. That is where Comrade Financial Group can help. No Pressure, just information.

Jack Fleming – Insurance Broker

LIFE INSURANCE OWNERSHIP is at 50 Year LOW!

/in Affordable Health Insurance, Blog, Comrade Financial Group, Customer Service, DC Life Insurance, Family Insurance, Instant Quote, Maryland Life Insurance, Virginia Life Insurance /by Jack FlemingGreat article linked above but truthfully there are some

disturbing facts that are really shocking to me. I deal with

customers every day and the biggest reason why families

dont have quite enough Life Insurance is mainly due finances.

Insurance Brokers are your best bet as far as I am concerned.

They have the freedom and ability to match you with a

product to fit your budget! I don’t have to tell you about what

a premature passing of the sole breadwinner will do, since this

is America and we all need two incomes to supports our lifestyles.

Maybe we only care about ourselves these days. Who cares if JR

will have college paid for. Who cares if MOM will have to go back

to work. Well I care and if you do to, then stop by

Comrade Financial Group and I would be very pleased to help you.

Jack Fleming – Insurance Broker